Metaplanet Stock Soars After $5.4B Bitcoin Purchase Plan Aiming for 210,000 BTC

Metaplanet shares jump 22% after unveiling plans to buy $5.4 billion worth of Bitcoin, aiming to become the second-largest BTC holder among public companies.

Metaplanet Eyes Massive Bitcoin Treasury Expansion

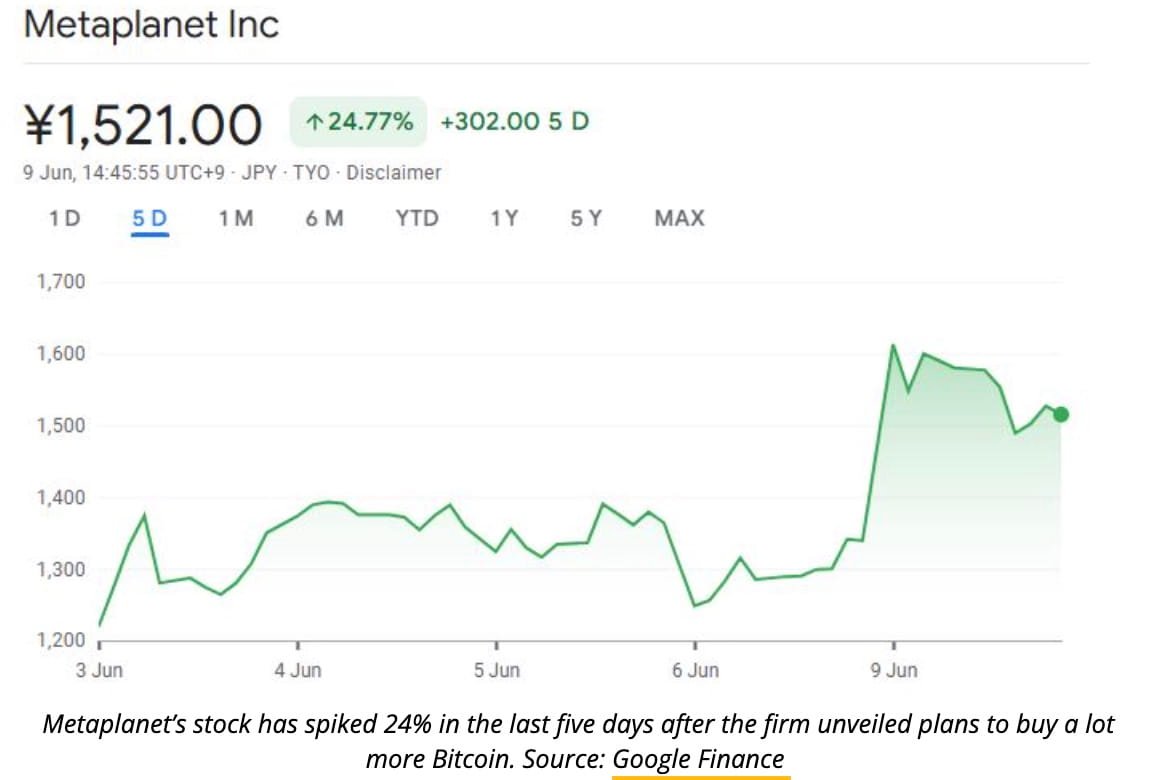

Japanese investment firm Metaplanet (3350.T) saw its stock price spike over 12% at the open on June 9 after revealing an ambitious plan to buy 210,000 Bitcoin (BTC) by the end of 2027. The announcement has driven investor excitement, with the stock hitting intraday highs of 1,641 yen ($11.36) — a 22% jump, according to Google Finance.

The announcement came via a June 6 update to the company’s stock acquisition rights program, where Metaplanet unveiled its so-called “555 million plan”, a major expansion from its previous goal of holding 21,000 BTC.

What Is Metaplanet’s 555 Million Bitcoin Strategy?

Under the new plan, Metaplanet aims to increase its Bitcoin holdings from 8,888 BTC to 210,000 BTC over the next 2.5 years. The company currently holds 8,888 BTC, following a recent purchase of 1,088 Bitcoin disclosed on June 2.

The 555 million plan targets:

- 100,000 BTC by 2026

- 210,000 BTC by the end of 2027

- Estimated total acquisition cost: $21+ billion

If executed, Metaplanet will become the second-largest public Bitcoin holder, trailing only Michael Saylor’s MicroStrategy (Strategy), according to Bitbo data.

Corporate Bitcoin Adoption Continues to Accelerate

Metaplanet joins a growing list of public companies integrating Bitcoin into their balance sheets. Data from Bitbo shows that over 3 million BTC, worth more than $342 billion, is now held by corporations — representing 3.2% of the total BTC supply.

Notable recent moves include:

- K Wave Media (South Korea) entering the Bitcoin market on June 4.

- Blockchain Group (France) buying BTC in November 2024, with shares jumping 225%.

- DigiAsia Corp (Indonesia) announcing a $100 million Bitcoin treasury seed, leading to a 91% stock surge.

Even traditional companies like GameStop have jumped on the Bitcoin bandwagon, with shares rising 12% after announcing BTC purchases in March, though they later fell 11% in May after executing the buy.

Mixed Reactions From the Market

While Bitcoin buys have sparked rallies for some companies, not all have benefited. Norwegian crypto brokerage K33 saw its stock dip slightly (-1.96%) after announcing Bitcoin acquisition plans in late May.

Despite the occasional mixed reaction, investor sentiment continues to favor companies taking bold steps into Bitcoin, particularly when paired with aggressive multi-year strategies like Metaplanet’s.

Metaplanet’s move signals increasing institutional confidence in Bitcoin as a long-term strategic asset. If the firm succeeds in reaching its 210,000 BTC goal, it could reshape the leaderboard of corporate Bitcoin holders — and further solidify BTC's role in global capital markets.

#BTC

Comments 0

Most Read

Recommended Post

Leave a Comment